Wall Street was duped by false promises of success from "summary" of Bad Blood by John Carreyrou

Wall Street's gullibility was on full display as Theranos managed to secure massive investments based on nothing but false promises. The company's founder, Elizabeth Holmes, was able to manipulate investors with her charisma and unyielding confidence in the success of her blood-testing technology. Despite the lack of concrete evidence or scientific validation, Wall Street continued to pour money into Theranos, believing in the vision that Holmes had painted for them. Holmes was a master of deception, using her carefully crafted persona to lure in even the most seasoned investors. She was able to sell the idea of a revolutionary technology that would change the healthcare industry forever, despite the fact that Theranos was unable to deliver on any of its promises. The company's board members, many of whom were well-respected individuals in the business world, also fell victim to Holmes' manipulation, further perpetuating the false narrative of success that Theranos had created. The media played a crucial role in perpetuating the myth of Theranos, with journalists praising the company and its founder without questioning the validity of their claims. This helped to create a sense of legitimacy around Theranos, further convincing investors that they were making a sound investment. As a result, Wall Street continued to pour money into Theranos, leading to a valuation of over $9 billion at its peak. However, as more information about Theranos began to surface, it became clear that the company was built on a foundation of lies. The technology did not work as promised, and the company had been engaging in fraudulent practices to cover up its shortcomings. Despite the mounting evidence against Theranos, Wall Street continued to believe in the company, refusing to acknowledge the reality of the situation. In the end, Wall Street's blind faith in Theranos proved to be its downfall. The company's eventual collapse was a stark reminder of the dangers of investing based on nothing but false promises and hype. The lesson learned from the Theranos scandal is a valuable one for investors, highlighting the importance of due diligence and skepticism when evaluating potential investments.Similar Posts

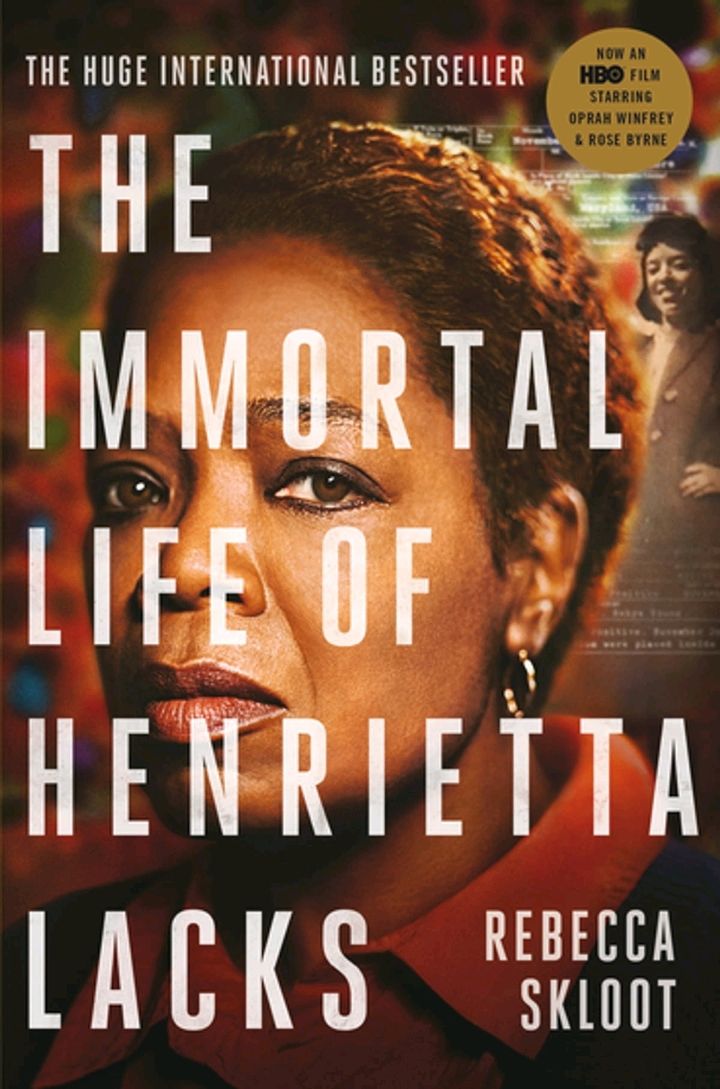

Skloot humanizes Henrietta by sharing her personal struggles and triumphs

Throughout the pages of 'The Immortal Life of Henrietta Lacks,' we see Henrietta not just as a collection of cells in a lab, bu...

Strive for continuous improvement and learning

The path to success is paved with constant learning and improvement. It's about always seeking ways to grow, evolve, and adapt....

Mobile apps improve health outcomes

Mobile apps have emerged as a powerful tool in the realm of healthcare, offering the promise of improving health outcomes in a ...

Adapting to feedback is crucial in the fundraising process

Receiving feedback is an integral part of the fundraising process. When entrepreneurs seek funding for their startups, they are...

Disillusioned employee exposes fraudulent practices

The story of Theranos wouldn't be complete without mentioning Tyler Shultz, a young employee who decided to blow the whistle on...

The company's demise was a stark warning about unchecked ambition

The downfall of Theranos served as a cautionary tale, a sobering reminder of the perils of unbridled ambition. The company's ra...

Cults of personality formed around charismatic leaders

The idea of people gravitating towards charismatic leaders and forming cults of personality around them is not a new phenomenon...